Retirement Planning

Take charge of your retirement financial planning

As average life expectancy continues to rise, the process of planning for retirement is becoming more challenging.

Having worked hard throughout life, we all want to look forward to a comfortable retirement, perhaps one which involves endless adventures or one that involves sharing our wealth and making memories with those we love. To ensure our wishes are fulfilled, it is essential to have a well-advised, detailed retirement plan in place.

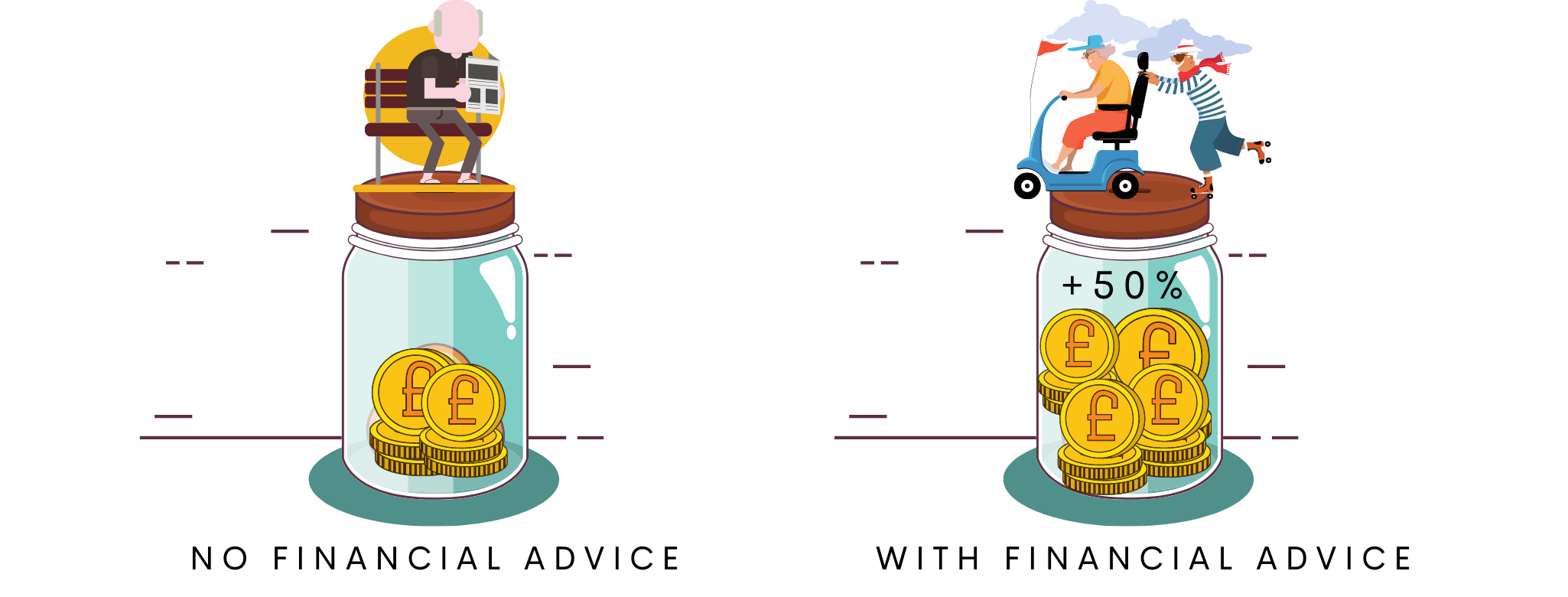

People who plan their retirement and seek advice have on average a nearly 50% larger pension pot*, and feel 20% more fulfilled** than those who do not.

*(Office for National Statistics, Wealth and Assets Survey 2019). **(Visual Capitalist, BlackRock Investor Pulse Survey 2018).

How we can help

The Wealth Consultant offers independent advice tailored to your requirements, goals, and life-stage. We will connect you with a wealth manager who can answer key questions, such as:

What is a good retirement goal?

How do I create a retirement plan?

What is the best retirement plan for me?

We understand that planning for retirement can be complicated and somewhat daunting. The Wealth Consultant aims to cut the complexities and provide you with honest, reliable and timely information.

Get personalised retirement planning advice

Clients often report a lack of trust in traditional financial services whom they feel do not provide enough advice on retirement planning options. With extensive experience in the wealth management sector, we act with integrity to bring you closer to wealth managers who will professionally advise you on the most appropriate way you can plan for retirement. We will only connect you with wealth managers who will foster a professional trusting relationship with you which will inspire confidence and allow you to look forward to retirement.

The time-consuming process of selecting a wealth manager can often leave investors feeling frustrated. We streamline that process by first, taking the time to learn about your lifestyle, your health and how you plan to spend your retirement. This enables us to connect you with industry-leading wealth managers who can manage your expectations and support you to achieve the retirement you have worked all your life to enjoy.

How we work

Our transparent and client centric structured wealth management process offers you peace of mind knowing that we use specialist industry knowledge to find the perfect wealth manager for you, free of charge!

Answer 10 simple questions about your situation and requirements. This will take no longer than 3 mins.

The Wealth Consultant will call you within 24 hours to clarify your details and discuss your matched wealth managers with you.

The Wealth Consultant will introduce you to, and arrange a time for an initial call, in order to choose the right wealth manager for you.

Dedicated Wealth Manager for you

Time to stop searching. Let The Wealth Consultant do the hard work for you. Get in touch today for a free consultation and digital introduction to the most appropriate wealth manager for you.